What Office Expenses Can I Claim . The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The portion you can claim.

from excelxo.com

Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The portion you can claim. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes.

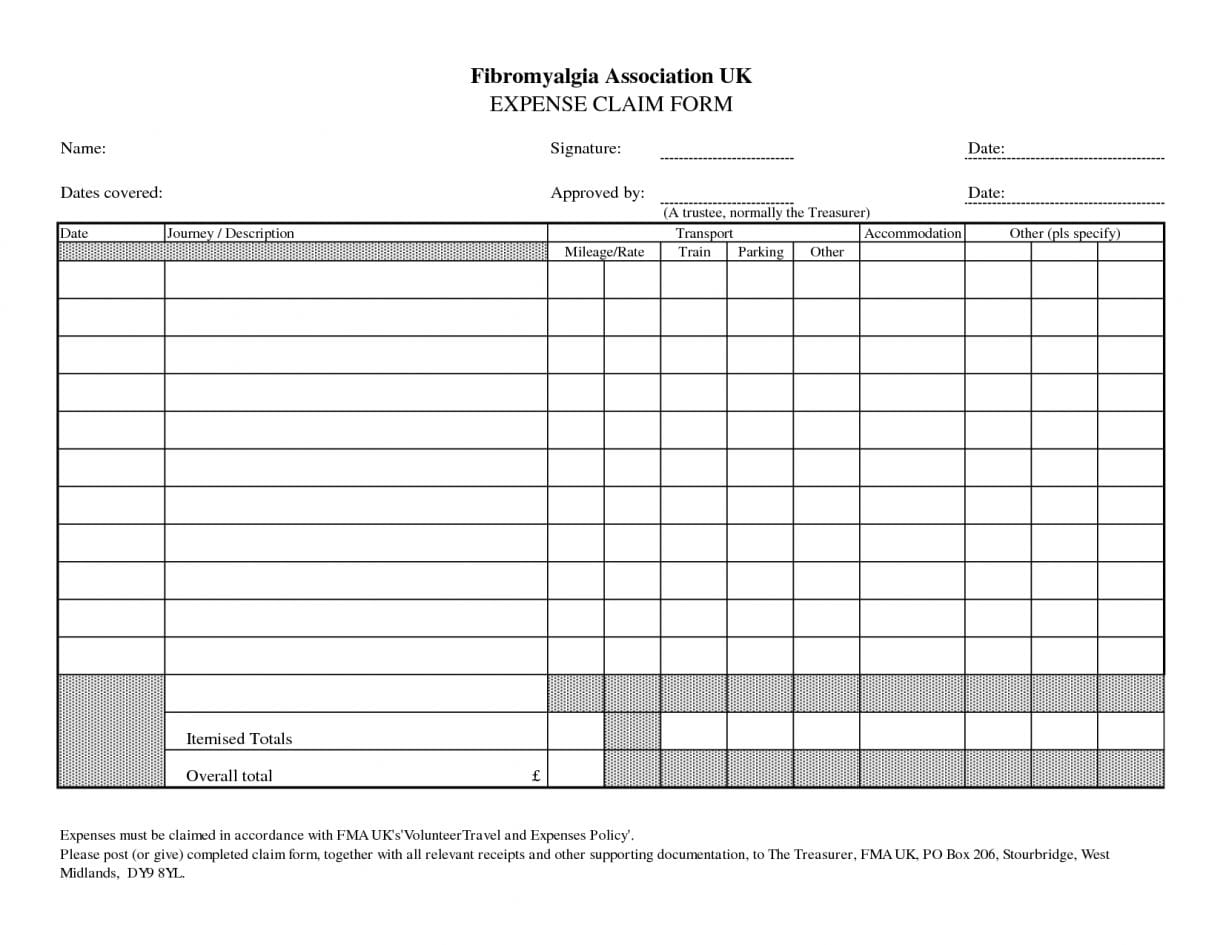

expense claim form template microsoft office 1 —

What Office Expenses Can I Claim “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The portion you can claim. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest.

From doctemplates.us

Expense Claim Form FREE 34+ Claim Forms in PDF DocTemplates What Office Expenses Can I Claim “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The portion you can claim. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The. What Office Expenses Can I Claim.

From www.smartsheet.com

Free Excel Expense Report Templates Smartsheet What Office Expenses Can I Claim The portion you can claim. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From db-excel.com

Business Expenses Claim Form Template — What Office Expenses Can I Claim The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning,. What Office Expenses Can I Claim.

From onlinebusiness.umd.edu

How to Categorize Expenses and Assets in Business UMD Online What Office Expenses Can I Claim The portion you can claim. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file. What Office Expenses Can I Claim.

From www.abc10.com

Can I write off home office expenses during the pandemic? What Office Expenses Can I Claim The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. Understand the types of. What Office Expenses Can I Claim.

From templates.rjuuc.edu.np

Expenses Claim Form Template Excel What Office Expenses Can I Claim The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The portion you can claim. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to. What Office Expenses Can I Claim.

From www.pinterest.pt

Expense Report Spreadsheet Template Excel (3) PROFESSIONAL TEMPLATES What Office Expenses Can I Claim The portion you can claim. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The. What Office Expenses Can I Claim.

From www.weallcount.com.au

What Home Office Expenses Can I Claim? We All Count What Office Expenses Can I Claim Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning,. What Office Expenses Can I Claim.

From www.senomix.com

Easy Time and Expense Tracking With Senomix Timesheets What Office Expenses Can I Claim You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning,. What Office Expenses Can I Claim.

From template.wps.com

EXCEL of Expenses Claim Sheet.xlsx WPS Free Templates What Office Expenses Can I Claim The portion you can claim. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From www.afirmo.com

How to claim home office expenses Afirmo NZ What Office Expenses Can I Claim The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. The portion you can claim. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From www.generalblue.com

Expense Claim Form in Word (Basic) What Office Expenses Can I Claim Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. The portion you can claim. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The. What Office Expenses Can I Claim.

From sample-excel.blogspot.com

9+ Expense Claim Form Sample Excel Templates What Office Expenses Can I Claim Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning,. What Office Expenses Can I Claim.

From exceltemplate77.blogspot.com

Monthly Expense Report Excel Templates What Office Expenses Can I Claim The portion you can claim. Understand the types of allowable employment expenses that may be deducted against your employment. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From www.sampleforms.com

FREE 44+ Expense Forms in PDF MS Word Excel What Office Expenses Can I Claim You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The portion you can claim. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From wordtemplate.net

Expenses Claim Form Template What Office Expenses Can I Claim The portion you can claim. Understand the types of allowable employment expenses that may be deducted against your employment. The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. “commission earners”) can deduct rent, repairs to the. What Office Expenses Can I Claim.

From www.vrogue.co

Expense Claim Form Expense Claim Form Template Word E vrogue.co What Office Expenses Can I Claim The portion you can claim. Understand the types of allowable employment expenses that may be deducted against your employment. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to their. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The. What Office Expenses Can I Claim.

From myexceltemplates.com

Expense Claims Form Expense Claim Excel Template What Office Expenses Can I Claim The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You can claim a portion of your household expenses, such as rates, insurance, power and mortgage interest. The portion you can claim. “commission earners”) can deduct rent, repairs to the premises, rates and taxes, cleaning, wear and tear and all other expenses relating to. What Office Expenses Can I Claim.